Things To Take Into Consideration While Buying Life Insurance

Things To Take Into Consideration While Buying Life Insurance

What Is Life Insurance?

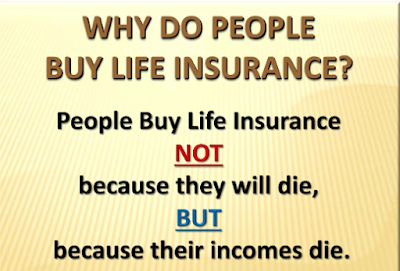

Life coverage is a economic service that you may purchase into to be able to help to shield your loved ones inside the event of your loss of life. Most people will purchase life insurance for fixing a basic trouble, that's how your circle of relatives gets alongside with out you after you die.

Your existence coverage policy is an exceptional way to assure that anybody you love that you leave in the back of, or your favorite charity, will acquire the financial safety after you are long gone.

Your existence coverage policy is an exceptional way to assure that anybody you love that you leave in the back of, or your favorite charity, will acquire the financial safety after you are long gone.

These are a few not unusual life coverage questions humans will have:

What are the one-of-a-kind varieties of lifestyles insurance and which one is better?

Generally, life insurance will come in varieties. Term lifestyles will cover you for a fixed quantity of time, so as to commonly be one to 30 years. The protection will expire once the period is up, which means that you need to qualify for it after which purchase a distinct policy when you need to continue the insurance. The 2d type is referred to as everlasting life insurance, with the maximum commonplace type being whole lifestyles, which will cowl you in the course of your lifetime, just so long as the bills are made to the coverage organization. It can even building up assured cash value over time, and the cash may be used at some point of your lifetime, tax-free.

Things To Take Into Consideration While Buying Life Insurance

How a lot life insurance do I need?

Life coverage corporations will now and again calculate this in some special ways. The elements will include what number of dependents you've got, what you anticipate to earn, the life-style that you want your family to have and much extra. A precise rule of thumb is that if you take place to be in your 20s, the right insurance amount will be approximately 30 times your ordinary earnings. As you age, less is probably obtained. When you are for your 50s, you could simplest want ten times your profits.

Is existence coverage thru my workplace enough?

There are a number of agencies so as to offer organization-paid coverage as an employee benefit. While that is a nice perk, you have to appearance carefully at the amount of cash your family will simply receive. The chances are exact that base coverage isn't always going to satisfy primary needs for very long. You may be capable of upload on more coverage with an additional charge each length, so it will likely be really worth looking into, as well as a policy that you will be able to take with you if you ever lose your process or go away. Some organization advantages can be transportable so you can avoid the coverage expiring.

Is there a bodily exam required?

If you have got a traditional organization plan like you may have at paintings, there's no examination this is required with the aid of the life insurance organization for your number one insurance. If you've got a non-public plan, it may vary. When a existence insurance company does now not want a bodily exam, they may be playing on the concept that you are in desirable reasonable health.

Can I Qualify for Life Insurance If I am Unemployed?

There are motives to be worried that you can no longer qualify for lifestyles insurance when you have misplaced your activity. For one aspect, insurance underwriters ought to observe such things as your finances so that you can approve you for a policy. Not having adequate profits can be a hassle. They also observe your occupation, your fitness and your circle of relatives records. Obviously, several matters could motive an software to be denied, and one factor might be unemployment. In the latest years, quite a few businesses are imparting inexpensive insurance to those who are unemployed or retired. So, don’t worry as there are alternatives to be had. You need to save around and search for a respectable policy.

0 Response to "Things To Take Into Consideration While Buying Life Insurance"

Post a Comment